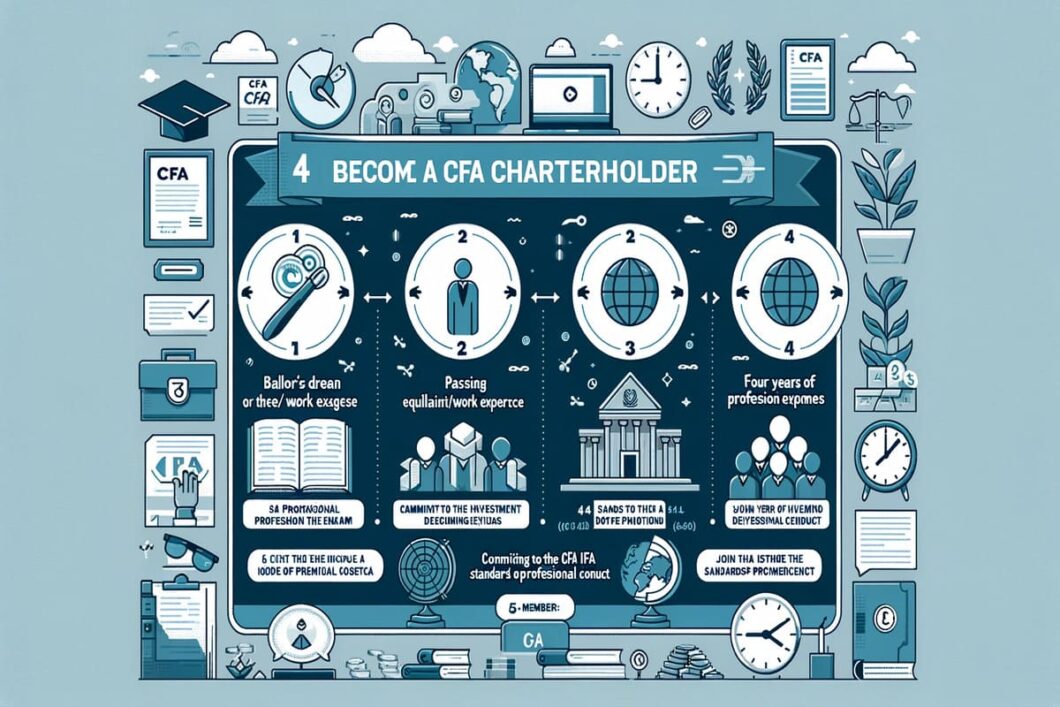

Becoming a CFA (Chartered Financial Analyst) charterholder is a prestigious achievement in the finance industry, signaling a strong understanding of advanced investment analysis and real-world portfolio management skills. The journey to earning the CFA charter involves meeting several requirements, designed to ensure that candidates have the depth of knowledge, competence, and ethical grounding necessary to excel in the financial sector. Here’s a detailed overview of the requirements to become a CFA charterholder:

- Pass the CFA Exams

The most well-known requirement for becoming a CFA charterholder is passing three rigorous exams, commonly referred to as Levels I, II, and III. These exams are designed to test the candidate’s knowledge of a wide range of financial topics, including but not limited to:

- Ethical and professional standards

- Quantitative methods

- Economics

- Financial reporting and analysis

- Corporate finance

- Equity investments

- Fixed income

- Derivatives

- Alternative investments

- Portfolio management and wealth planning

Each level of the exam builds on the last, with Level I focusing on basic knowledge and comprehension, Level II on application and analysis, and Level III on synthesis and evaluation, particularly in portfolio management.

- Acquire Qualified Work Experience

To ensure that CFA charterholders not only have theoretical knowledge but also practical expertise, candidates must accumulate at least 4,000 hours of relevant work experience over a minimum of three years. This experience must be directly related to the investment decision-making process or in producing a work product that informs or adds value to that process. Examples include roles in portfolio management, research, consulting, risk analysis, and investment banking, among others.

- Join the CFA Institute

Candidates must become members of the CFA Institute, the global association of investment professionals that administers the CFA Program. Membership requires adherence to the CFA Institute’s code of ethics and standards of professional conduct, which are intended to promote integrity, competence, and respect within the finance industry.

- Apply for Charter Membership

After passing all three exams and accruing the necessary work experience, candidates can apply for charter membership to become a CFA charterholder. This process includes submitting professional references and documentation of work experience for review by the CFA Institute.

- Commit to Continuing Education

Even after earning the charter, CFA charterholders are encouraged to engage in continuous education to keep up with the changing dynamics of the financial markets and to maintain their expertise. While not a formal requirement for maintaining the charter, many charterholders participate in the CFA Institute’s Continuing Education Program to further their knowledge and skills.

Becoming a CFA charterholder is a challenging process that requires dedication, time, and a commitment to ethical standards. However, the charter is widely recognized as the gold standard in the investment profession, opening doors to career advancement, greater credibility, and a global network of finance professionals.