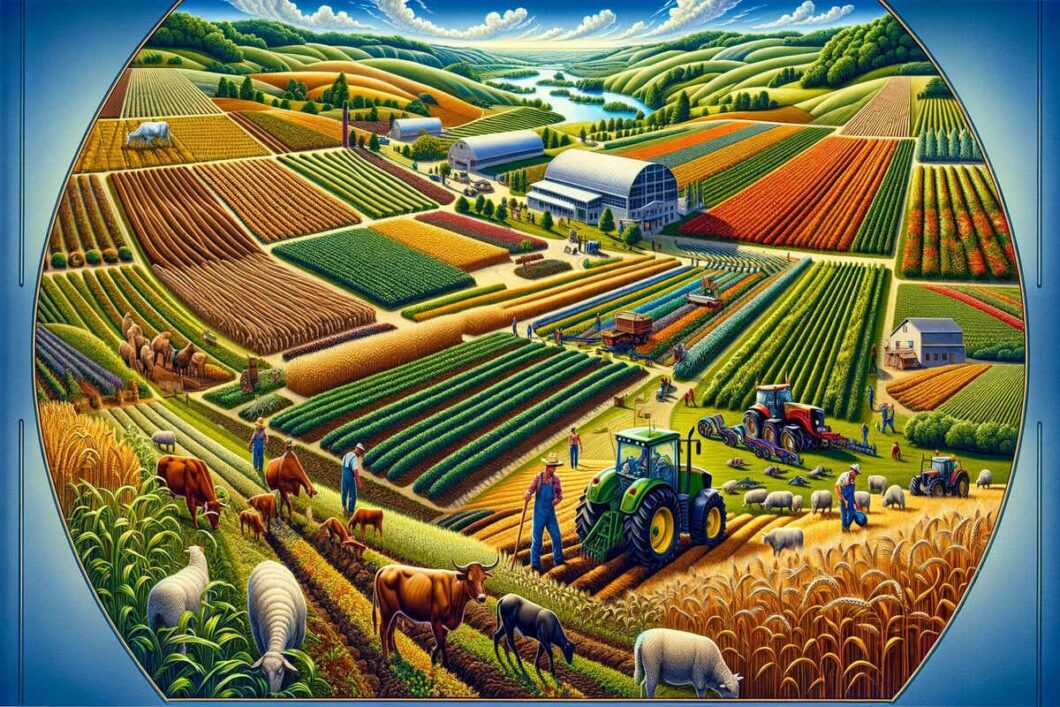

IAS 41, titled “Agriculture,” is an International Accounting Standard that prescribes the accounting treatment, financial statement presentation, and disclosures related to agricultural activity. Here’s an engaging explanation tailored for accounting and finance professionals:

- Objective of IAS 41: The primary objective of IAS 41 is to establish a standardized approach to accounting for biological assets (like plants and animals) and agricultural produce at the point of harvest. This standard ensures that entities involved in agricultural activities present their financial information transparently and consistently.

- Scope and Application: IAS 41 applies to all entities engaged in agricultural activity, which is defined as the management of the biological transformation of biological assets (living plants or animals) into agricultural produce (harvested product of the entity’s biological assets). It excludes land related to agricultural activity and intangible assets like water rights or brands.

- Key Definitions:

Biological Assets: These are living plants or animals. Examples include sheep, trees in a timber plantation, and grapevines.

Agricultural Produce: This is the harvested product of an entity’s biological assets. Examples include wool from sheep, logs from trees, and grapes from a vineyard.

- Recognition and Measurement:

Biological assets are recognized when the entity controls the asset as a result of past events, it is probable that future economic benefits will flow to the entity, and the fair value or cost can be measured reliably.

These assets are initially measured at their fair value minus estimated point-of-sale costs, unless this fair value cannot be measured reliably. In that case, they are measured at cost.

- Gains, Losses, and Changes in Fair Value:

IAS 41 requires entities to include any gains or losses arising from changes in the fair value of biological assets in their profit or loss for the period in which they occur.

Changes in fair value can arise due to biological transformation, which includes growth, degeneration, production, and procreation that cause changes in quantity and quality of the biological asset.

- Government Grants and Subsidies: If an entity receives government grants related to biological assets, it should account for these in accordance with IAS 20, Accounting for Government Grants and Disclosure of Government Assistance.

- Disclosure Requirements:

The standard requires entities to disclose the aggregate fair value of biological assets, the methods used to determine fair value, and any assumptions made in determining fair values.

Entities must also disclose the total gain or loss arising from changes in fair value and the description of any government grants related to biological assets.

IAS 41 significantly impacts entities in the agricultural sector, ensuring that financial statements reflect the unique nature of biological assets and agricultural produce. It aids in decision-making by providing relevant and reliable information about the financial implications of agricultural activities.

Have you found the insights in our blog posts helpful? They’re just the tip of the iceberg!

- In-depth analyses of the latest standards

- Expert interpretations to navigate complex financial landscapes

- Real-world examples for practical application

- Essential updates for 2024 and beyond

- And much more!

Don’t miss out on this essential resource for finance professionals. Subscribe now to get your copy and stay ahead in the ever-evolving world of international financial reporting!

[

[